Biggest Yearly Drop in Mortgage Rates Just Occurred

Mortgage rates had been stuck for what felt like forever — until last week, when they dropped noticeably.

On Friday, September 5th, the average 30-year fixed mortgage rate fell to the lowest level since October 2024. It was the biggest one-day decline in over a year.

What Caused Rates to Fall?

According to Mortgage News Daily, the drop in rates was triggered by the August jobs report, which came in weaker than expected for the second consecutive month. This signaled a potential economic slowdown to the financial markets, prompting a decrease in mortgage rates.

As confidence grows in the direction of the economy, markets tend to react accordingly — and historically, signs of a slowdown often lead to lower mortgage rates.

Why It’s Smart for Buyers to Pay Attention Right Now?

But this isn’t just about one day of headlines or one report. It’s about what the drop means for you.

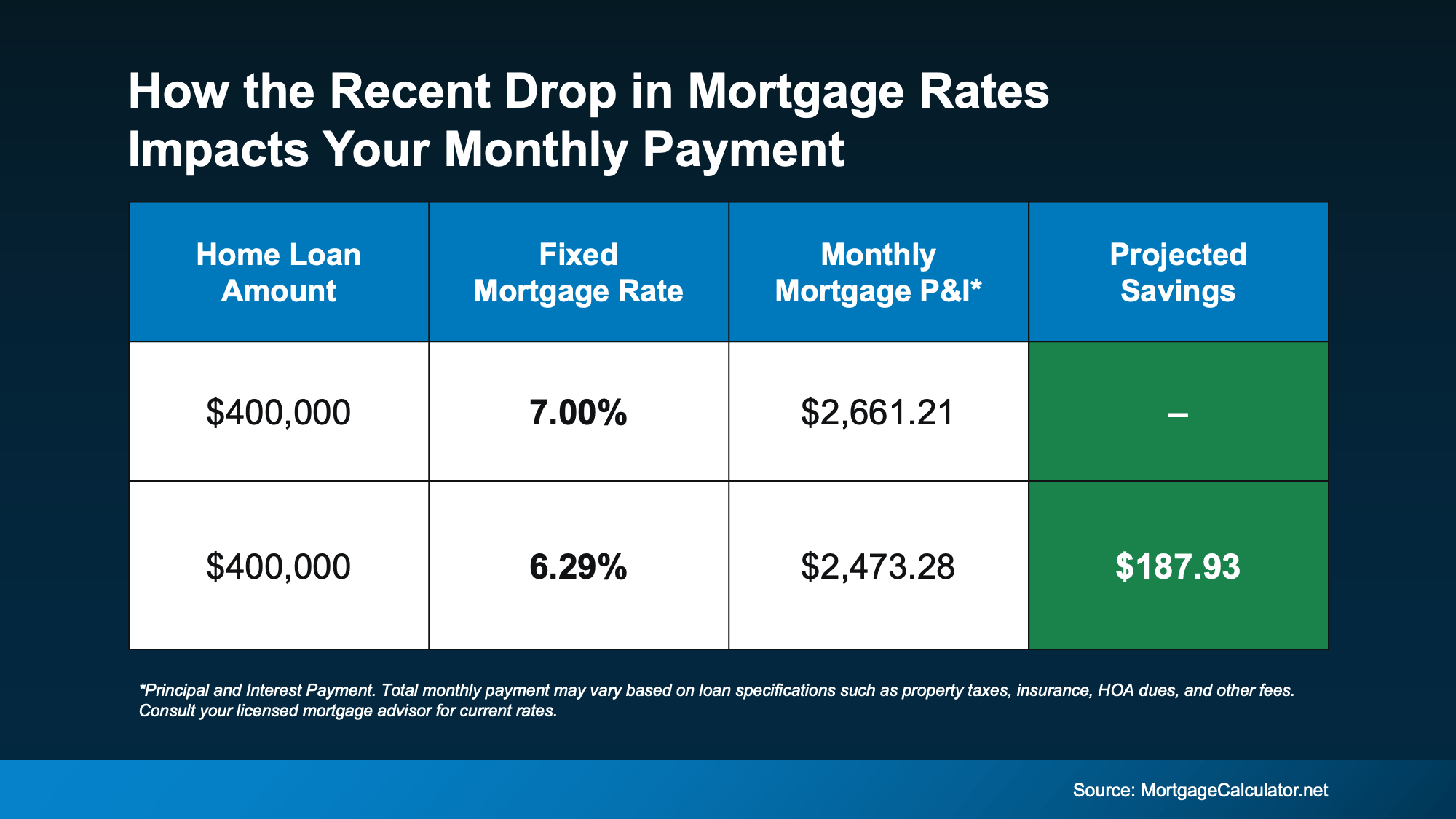

This recent change saves you money when you buy a home. The chart below shows you an example of what a monthly mortgage payment (principal and interest) would be at 7% (where mortgage rates were in May) versus where rates roughly are now:

Compared to just 4 months ago, your future monthly payment would be almost $200 less per month. That’s close to $2,400 a year in savings.

Compared to just 4 months ago, your future monthly payment would be almost $200 less per month. That’s close to $2,400 a year in savings.

How Long Can This Trend Continue?

That largely depends on how the economy and inflation evolve from here. Mortgage rates could dip further, or they might creep back up a bit.

That’s why it’s important to stay in touch with a knowledgeable real estate agent and a trusted lender. They’ll be monitoring key indicators like inflation trends, employment data, and upcoming decisions from the Federal Reserve to help you understand where rates might be heading next.

In the meantime, here’s what matters: Even though no one can predict exactly what comes next, the recent shift in mortgage rates—after months of little movement—is a positive sign. If you’ve been feeling stuck, this may be the opening of a new opportunity. As Diana Olick, CNBC’s Senior Real Estate and Climate Correspondent, puts it:

“Rates are finally breaking out of the high 6% range, where they’ve been stuck for months.”

And that’s gives you more reason to hope than you've had in quite some time.

The Main Point

The shift you’ve been waiting for is here.

Mortgage rates just saw their most significant drop in over a year. If they remain at this level, a home that felt out of reach just a few months ago might now be within your budget.

Wondering how much today’s lower rates could save you each month? Let’s connect and explore your options.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "