Closing Costs, State by State — What Buyers Need to Know

Planning to Buy a Home This Year? Don’t Overlook Closing Costs

If you’re preparing to purchase a home, there’s one expense you’ll definitely want to plan for: closing costs.

Most buyers know they exist, but many don’t fully understand what they include—or how much they can vary depending on where you’re buying. Let’s break it down.

What Are Closing Costs?

Closing costs are the extra fees and expenses you pay at the final stage of your home purchase. These apply to every buyer. According to Freddie Mac, typical closing costs include:

-

Homeowners insurance

-

Title insurance

-

Loan application and origination fees

-

Credit report fees

-

Appraisal and inspection costs

-

Property survey

-

Attorney fees

Why They Vary So Much: National vs. Local Numbers

When you search online, you’ll usually see a national average suggesting that closing costs range from 2% to 5% of the home’s price. While that’s a good starting point, it doesn’t tell the whole story.

Your actual costs will also depend on:

-

Local taxes and fees (like transfer taxes and recording fees)

-

Regional service costs (such as title work, attorneys, and insurance rates)

In other words, even if two homes cost the same, the closing costs could be very different based on the state—or even the city—they’re in.

What Do Typical Closing Costs Look Like in Each State?

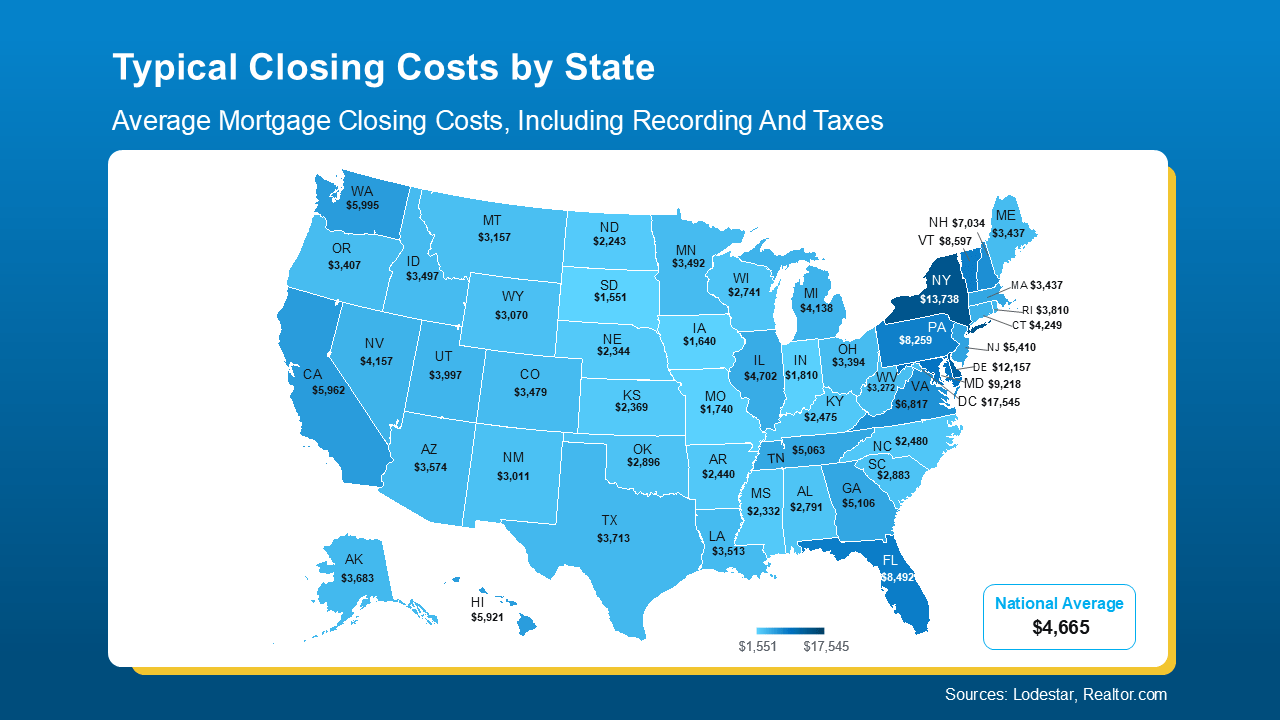

To help give you an idea, here’s a state-by-state breakdown of typical closing costs for the median-priced home in each area (see map below).

As you’ll see, some states have average closing costs around $1,000 to $3,000, while others can go up to $10,000 to $15,000. That’s a big difference—especially if you’re buying your first home. That’s why it’s essential to know what to expect before you start house hunting.

How To Get a More Accurate Estimate

To get a number that actually fits your situation, talk to a local real estate agent and a lender. They’ll be able to calculate an estimate based on:

-

Your budget and price range

-

The type of loan you’re using

-

The location and specific services required

Can You Reduce Your Closing Costs?

Yes—there are ways to potentially lower your out-of-pocket costs. According to NerdWallet, here are a few strategies:

-

Negotiate with the seller – You might be able to request seller concessions to help cover your closing costs.

-

Shop around for homeowners insurance – Get quotes from multiple providers to find the best rate.

-

Explore local assistance programs – Some states, professions, and communities offer programs to help cover closing costs. Ask your agent or lender about what’s available near you.

Key Takeaways

Closing costs are an important—but often underestimated—part of buying a home. Since they can vary so widely by location, understanding your local numbers (and how to potentially lower them) is key to building a solid homebuying budget.

Let’s talk about what closing costs typically look like in our area and put together a personalized estimate that works for you.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "