Home Equity Could Make Your Home More Possible

Before you rule out moving right now, take a look at this.

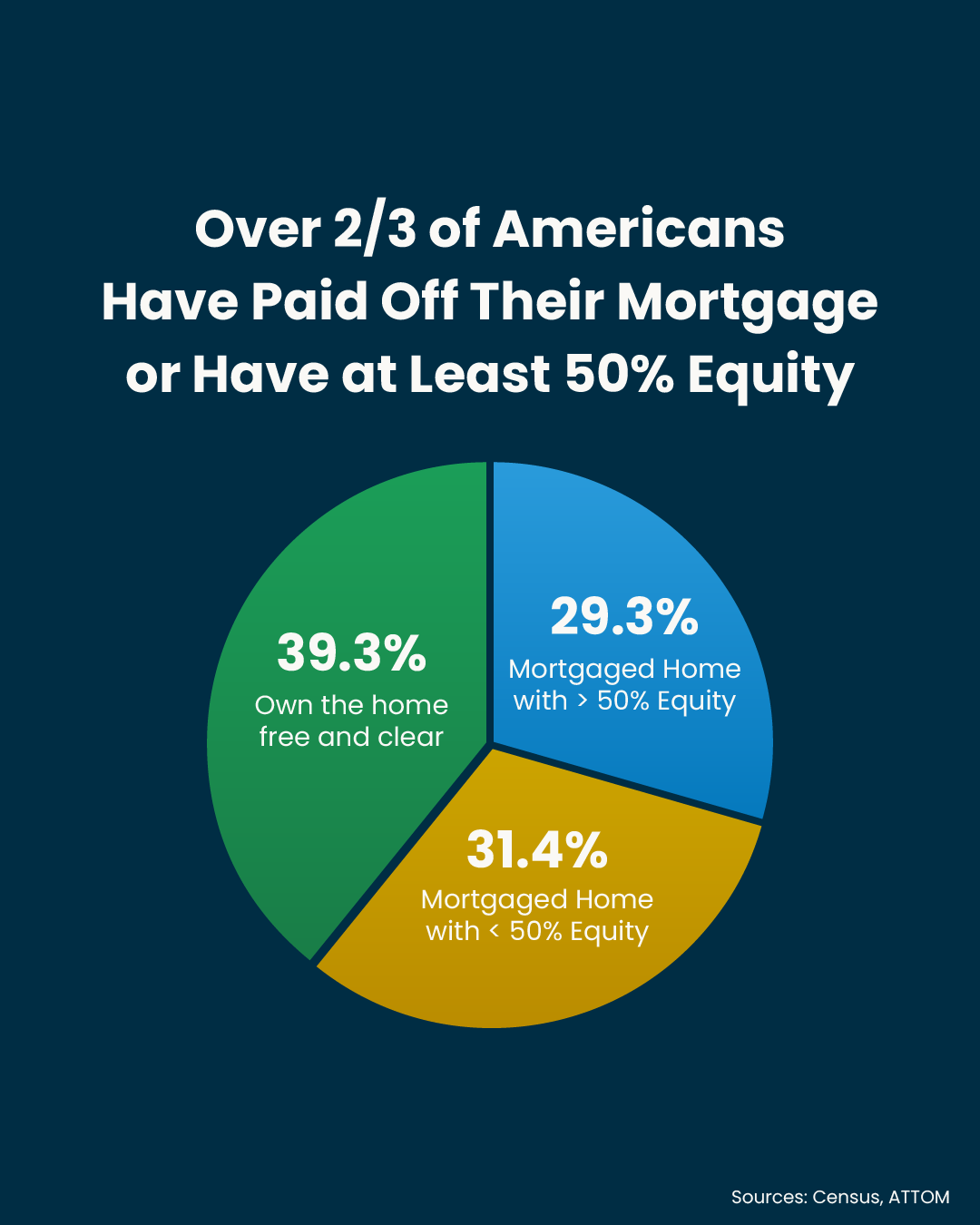

Thanks to how much home prices have climbed in recent years, the average homeowner has over $300K in equity.

And once you sell, you can use your equity to fund the down payment for your next home. And if you’re looking to downsize, you may even be able to buy in all cash.

So, if you’ve been on the fence about selling, let’s take a closer look at your numbers and how much equity you have. You might be surprised by what’s possible.

#HomeEquity #SellYourHouse #KeepingCurrentMatters

Categories

Recent Posts

Closing Costs, State by State — What Buyers Need to Know

Downsizing Made Easy: More Buyers Opting for Cash Transactions

Why the Current Market Presents Very Different Challenges for Buyers and Sellers

Affordability Is on the Rise — 3 Reasons This Fall Looks Promising for Buyers

Do You Truly Know What Your House Could Be Worth?

Why 2025 May Be the Ideal Year to Sell Your Property

How a Fed Rate Cut Might Impact Mortgage Rates

Waiting Won’t Sell Your Home — The Right Price Will.

Biggest Yearly Drop in Mortgage Rates Just Occurred

Why Half of Homes Sell Below Asking Price—and How You Can Prevent It

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "