What Homebuyers Say They Want Most — And How Today’s Market Is Responding

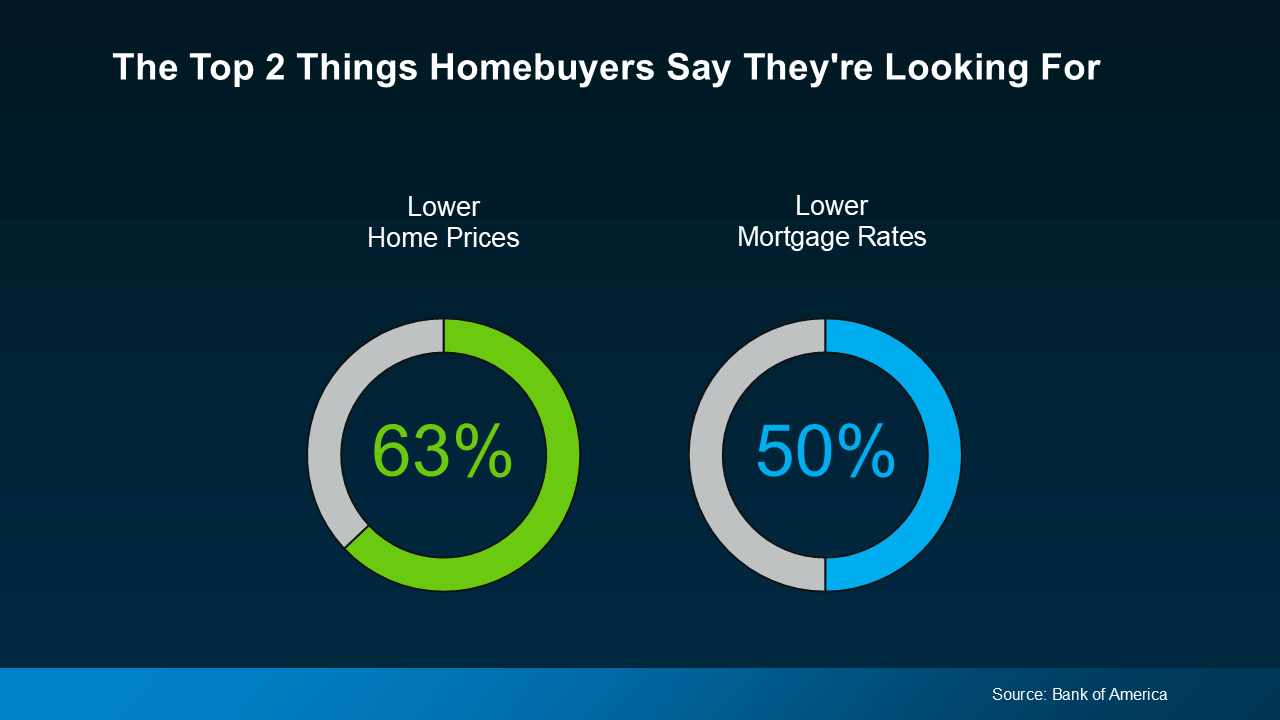

A recent Bank of America survey asked hopeful homebuyers what would make them feel more confident about jumping into the market. The top answers? No surprise — more affordability, especially when it comes to home prices and mortgage rates.

The good news: there are signs the market is responding. Let’s take a closer look at what’s changing.

Home Prices Are Cooling Down

In recent years, prices surged — in some cases by as much as 20% in just one year (2020–2021). That kind of spike made homeownership feel out of reach for many. But now, the pace is slowing.

Instead of double-digit growth, experts expect single-digit price increases this year — a much more typical and manageable rate.

That doesn’t mean home prices are dropping everywhere. Trends vary by region: some markets may still see increases, while others might level off or dip slightly. But overall, this moderation is good news for buyers trying to budget with more confidence.

Mortgage Rates Are Coming Down

Mortgage rates, which reached multi-decade highs, have also started to ease. That’s a welcome shift for buyers watching their monthly payments closely.

As Lisa Sturtevant, Chief Economist at Bright MLS, explains:

“Slower price growth coupled with a slight drop in mortgage rates will improve affordability and create a window for some buyers to get into the market.”

Even a small decline in rates can significantly reduce your monthly payment. While rate fluctuations are still likely, the trend for the year ahead points to rates staying in the low to mid-6% range — much better than the peaks we saw not long ago. Depending on economic conditions, they could dip even further.

Why It Matters

Confidence in the broader economy may still be shaky, but housing is showing signs of balancing out. Prices are no longer skyrocketing, and mortgage rates are trending downward.

These shifts won’t erase all affordability challenges overnight, but they do create more opportunity than earlier this year — especially for buyers who had previously hit pause.

Key Takeaways

The two biggest buyer concerns — home prices and mortgage rates — are both seeing positive movement. As these trends continue, they could open the door for more buyers to confidently re-enter the market heading into 2026.

If you’re thinking about making a move, let’s connect to review what’s happening locally and what it could mean for your next steps.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "