Why Experts Expect Mortgage Rates to Ease Over the Coming Year

You’ve been hoping for mortgage rates to drop — and they’ve started to. But is that trend here to stay? And how much lower could rates actually go?

Experts say there’s room for rates to fall even further over the next year. One key factor to watch: the 10-year Treasury yield. Here’s why that matters.

The Connection Between Mortgage Rates and the 10-Year Treasury Yield

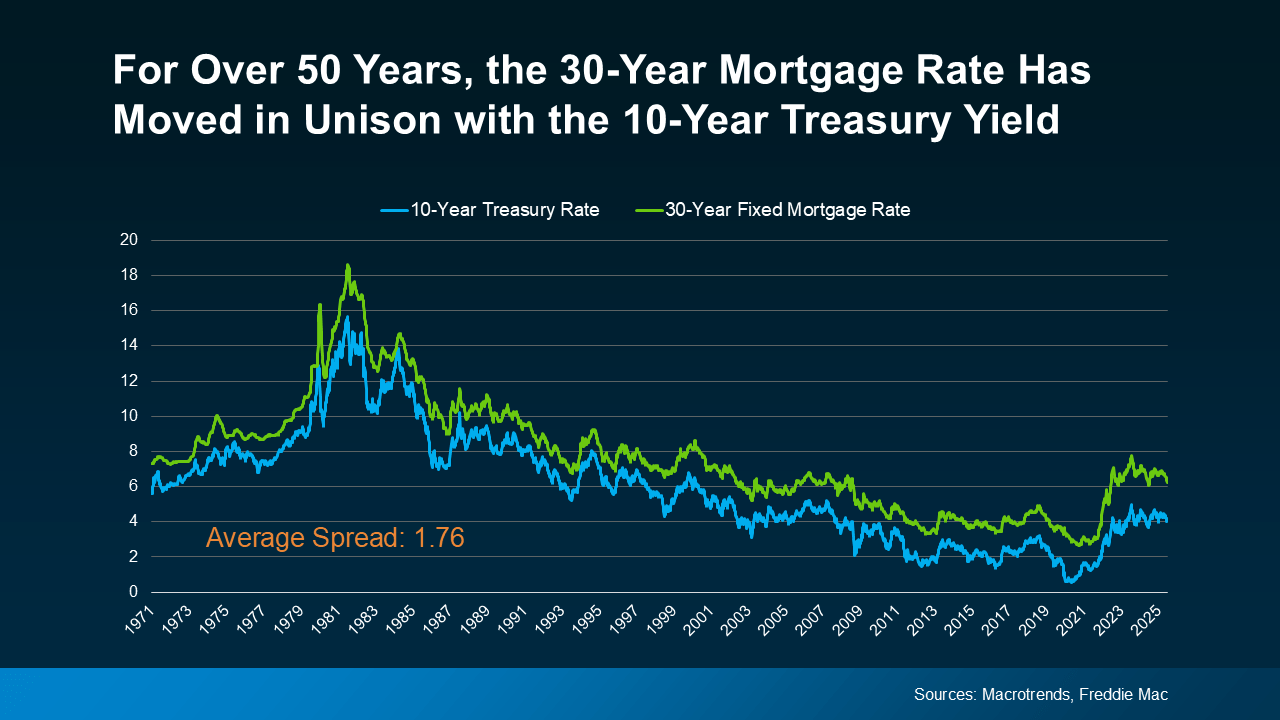

For over five decades, the average 30-year fixed mortgage rate has closely tracked the movement of the 10-year Treasury yield — a key indicator for long-term interest rates.

-

When the 10-year yield rises, mortgage rates tend to follow.

-

When it drops, mortgage rates typically decline too.

It’s a consistent trend that’s held up for more than 50 years.

See graph below:

This relationship is so strong that experts use the “spread” between the two — the difference in percentage points — to help predict mortgage rates.

The Spread Is Narrowing — And That’s a Good Sign

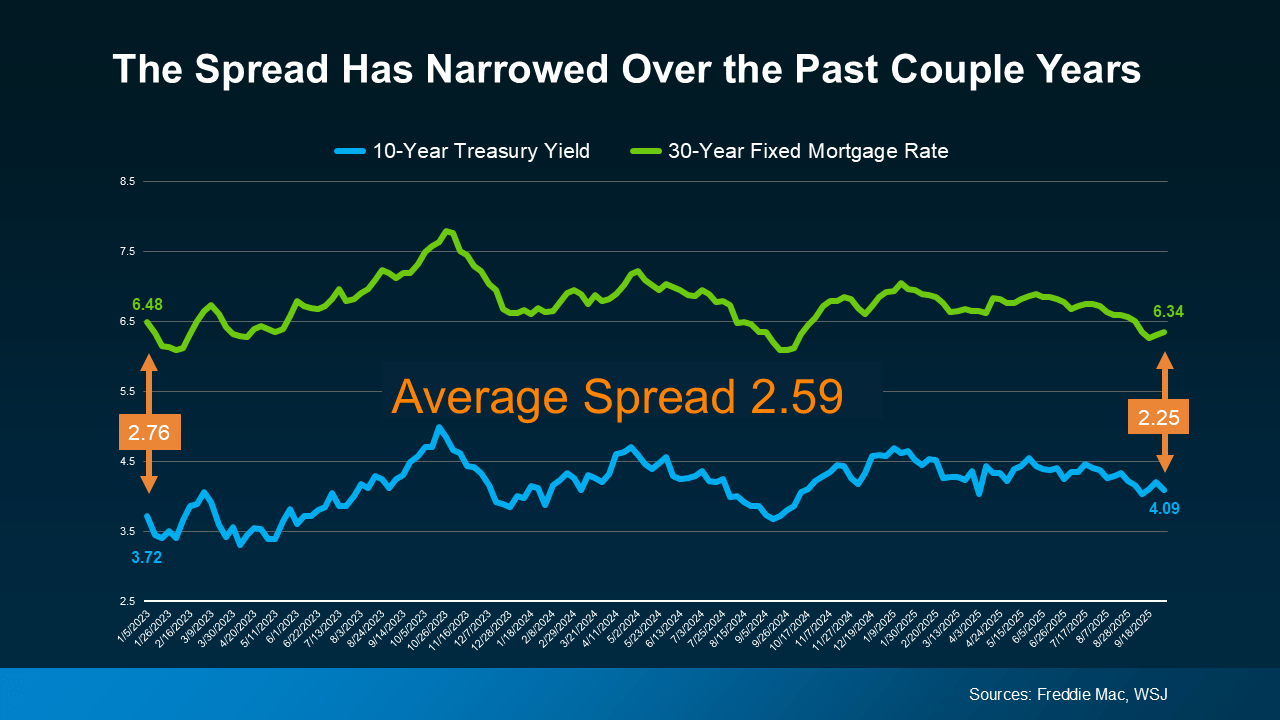

Historically, the spread between the 10-year yield and the 30-year mortgage rate averages about 1.76 percentage points (or 176 basis points). But recently, that spread has been unusually wide.

Why? The spread often grows when there’s uncertainty in the economy. Think of it as a fear gauge — the more economic uncertainty, the higher the risk premiums lenders build into mortgage rates.

But there’s reason for optimism:

That spread is now starting to shrink, signaling that confidence in the market is slowly returning.

See graph below:

As Redfin explains:

“A lower mortgage spread equals lower mortgage rates. If the spread continues to decline, mortgage rates could fall more than they already have.”

The 10-Year Treasury Yield Is Also Expected To Decline

It’s not just the spread that’s moving in a positive direction — forecasts also suggest the 10-year Treasury yield itself may drop in the months ahead. When you combine both a lower yield and a narrowing spread, you get two strong forces that could pull mortgage rates down further heading into 2026.

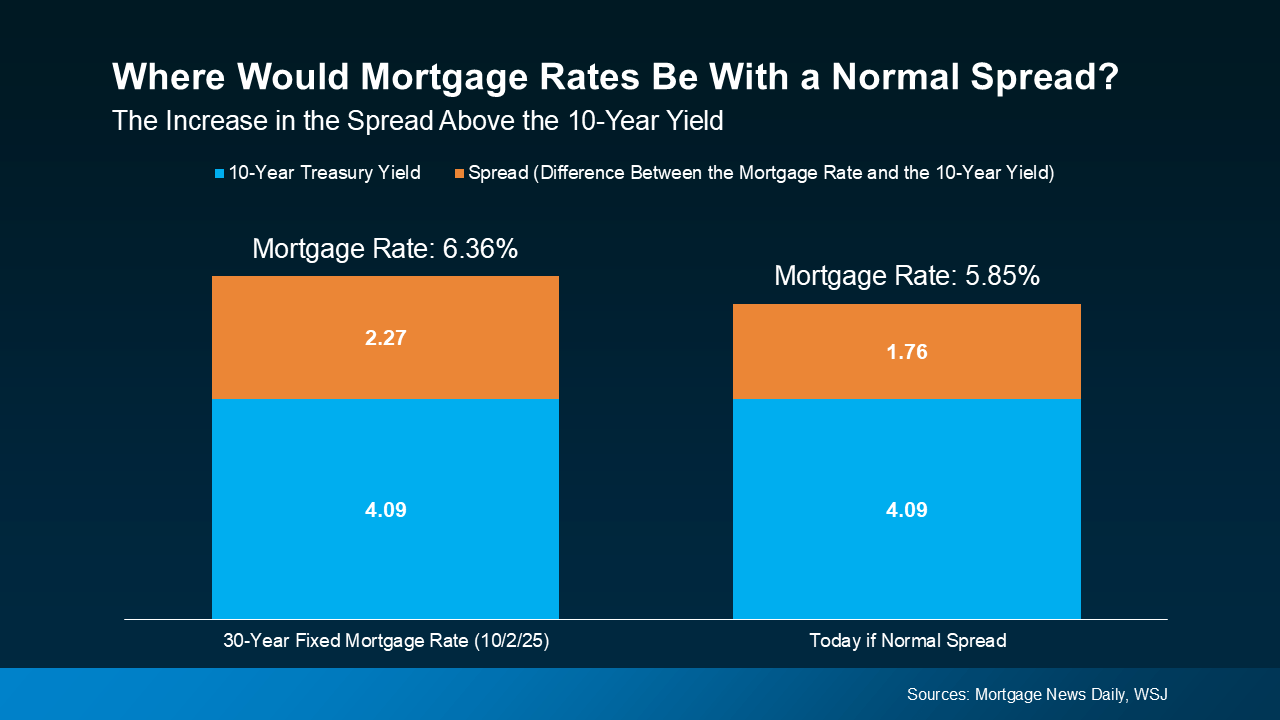

Let’s do the math:

-

Current 10-year yield = around 4.09%

-

Add the average spread of 1.76%

-

That puts projected mortgage rates at about 5.85%

See graph below:

That’s why many experts now believe rates could ease into the upper-5% range by the end of next year — a welcome shift from the 7%+ rates we’ve seen recently.

Of Course, There Are Variables

While the trend is promising, rates will still see ups and downs. Everything from inflation and job growth to Federal Reserve decisions can influence what happens next. But overall, the outlook for 2026 suggests a gradual decline in mortgage rates.

And we’re already seeing early signs of that shift starting to happen.

Key Takeaways

Keeping up with economic trends, rates, and market signals can be overwhelming — but you don’t have to do it alone.

Let’s connect so you can stay informed, take advantage of changing conditions, and make a confident move when the time is right.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "